Welcome

Welcome

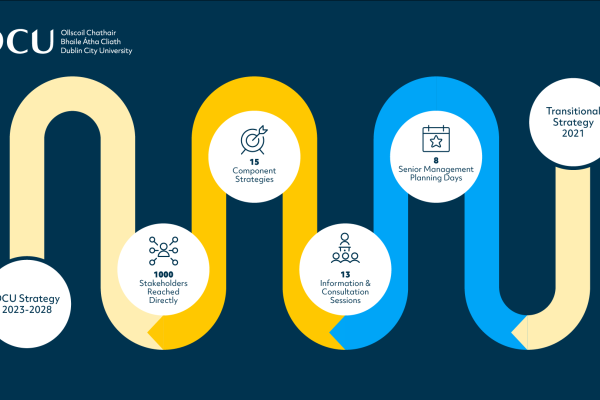

In 2023, we launched our ambitious strategy for how DCU will transform lives and societies. As part of this, we announced that the HR Department would be evolving to serve you better and would be renamed DCU People. Today, we’re delighted to announce the official launch of our new brand and provide more details.

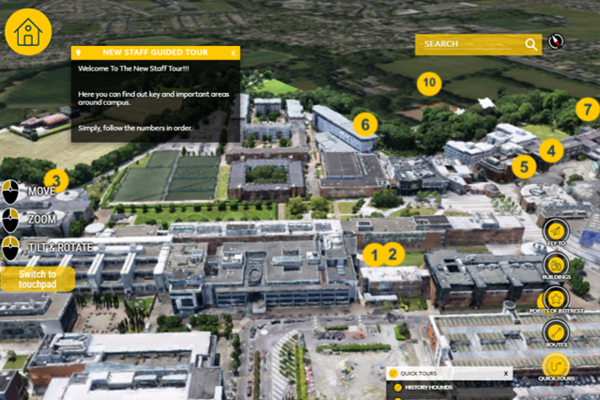

DCU People is more than just a name change and a new website, it's a transformation in how we support you through every stage of your career journey, offering resources like dedicated content for new employees, learning and development opportunities, performance and personal development tools, and leadership development programmes to help you Emerge, Thrive, and Lead at DCU.

Our mission is to cultivate a vibrant employee experience, one that’s centred on innovation and grounded in the principles of respect and mutual support.